√完了しました! in the absence of partnership deed what are the rules relating to interest on partners capital 278487-In the absence of partnership deed what are the rules relating to interest on partners capital

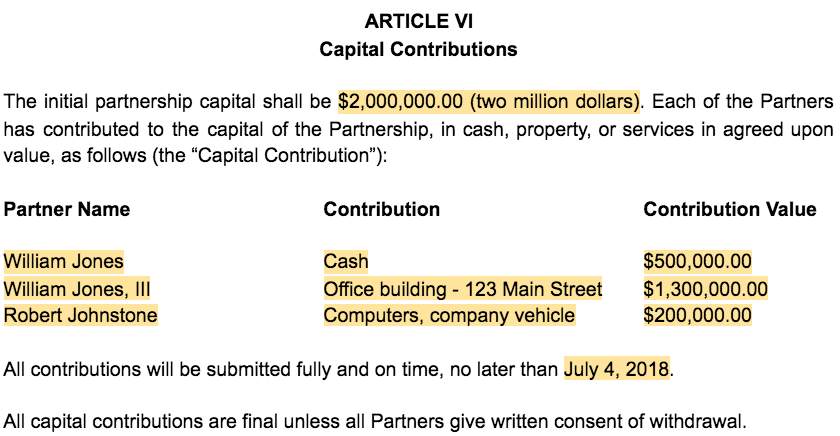

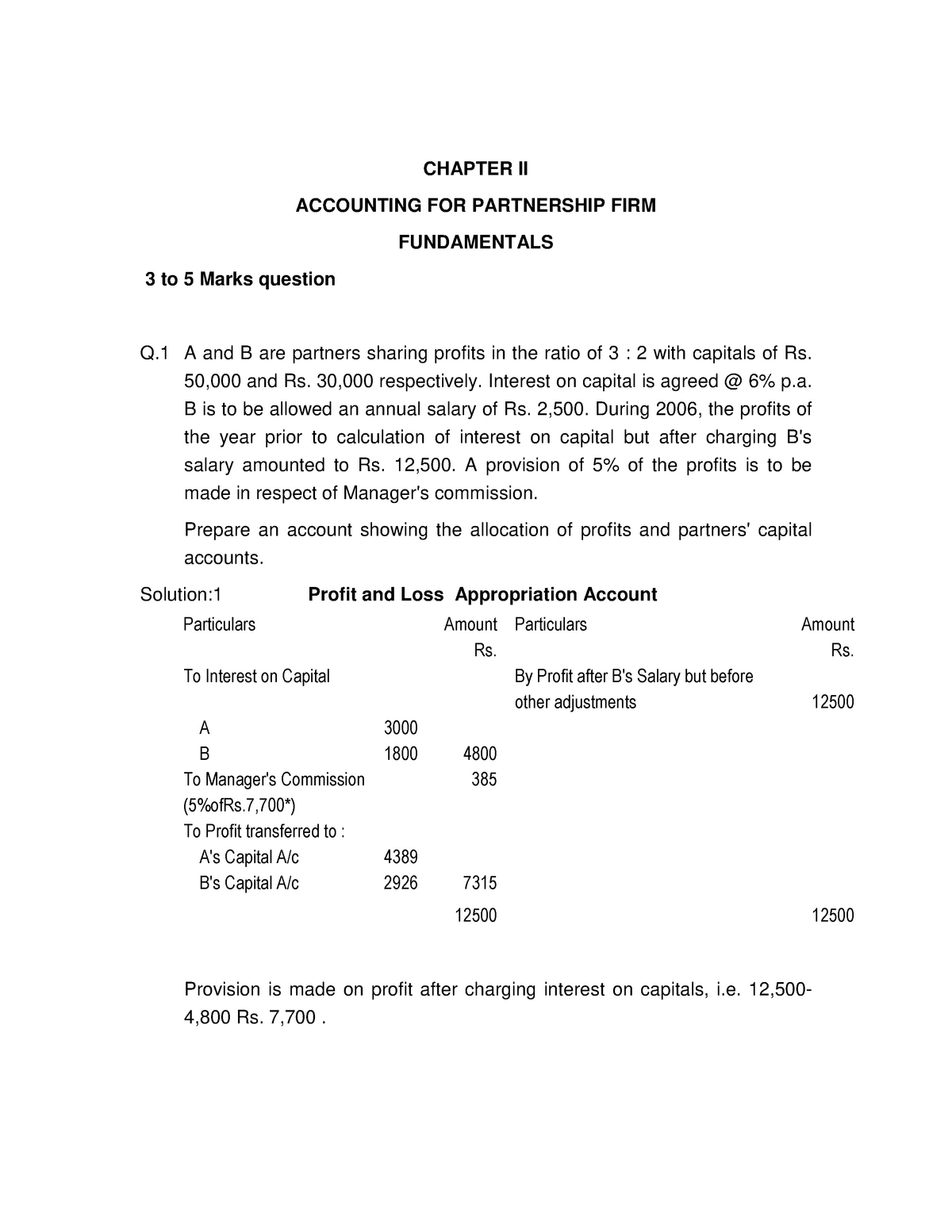

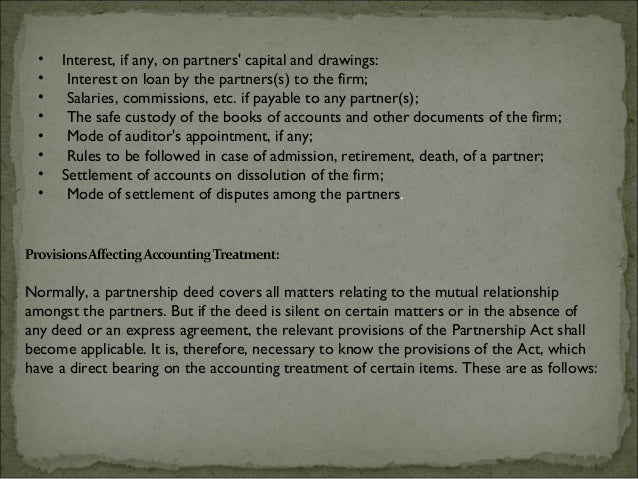

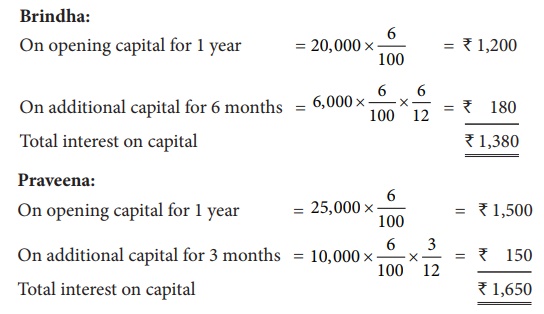

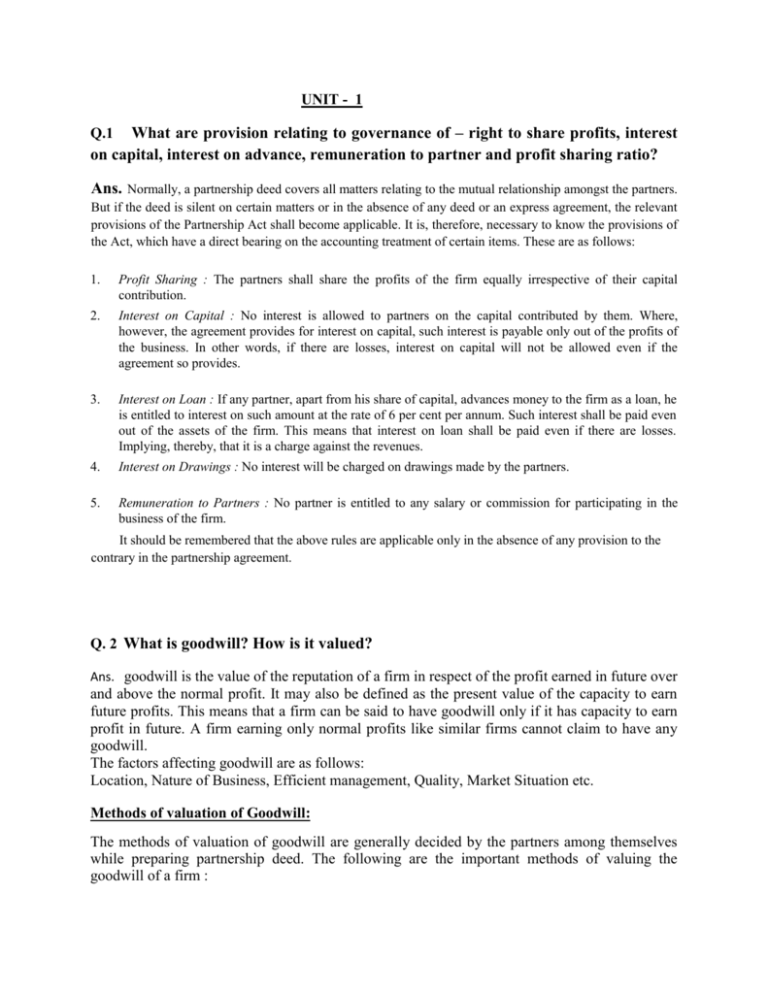

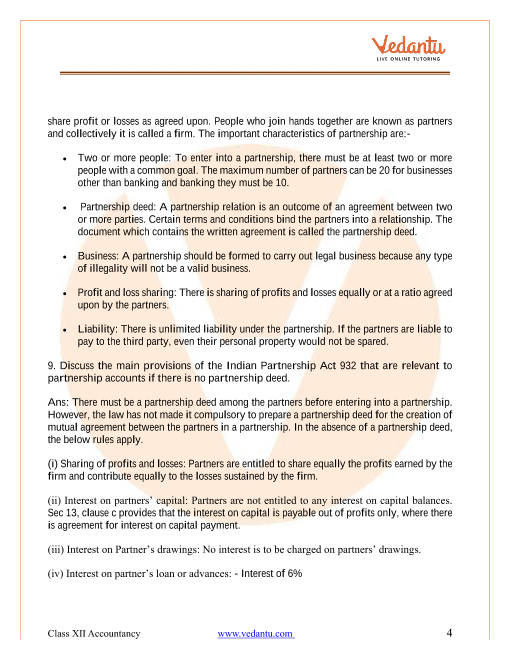

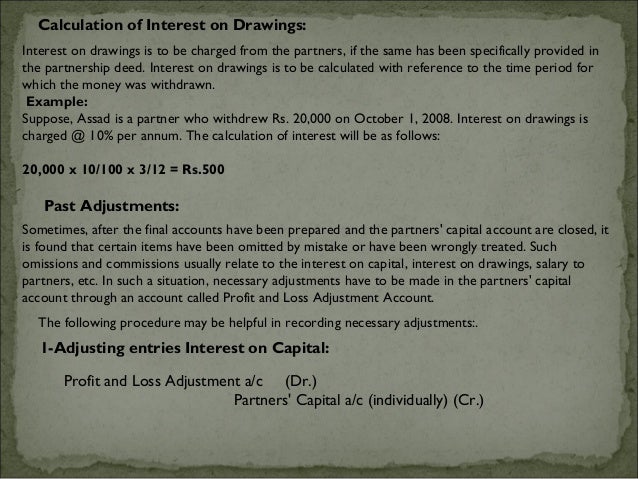

(iii) if the partnership deed allows interest on capital @ 5% pa Solution (i) Interest on capital will not be allowed as the partnership deed is silent as to the interest on capital (ii) Profit before interest on capital is ₹ 27,000 Computation of interest on capital Since there is sufficient profit, interest on capital will be provided In the absence of partnership deed, what are the rules relating to (a) Interest on partners capital (b) Interest on partners drawings (c) Interest on partners loan (d) Partners' profit sharing ratio (e) Salaries of partners Answer In the absence of partnership deed the provision affecting of Indian partnership act, 1932 are applicable theIn the absence of Partnership Deed, what are the rules relating to (a) Salaries of partners, (b) Interest on partners' capitals, (c) Interest on loan by partner, (d) Division of profit, (e) Interest on partners' drawings (f) Interest on loan to partners?

2

In the absence of partnership deed what are the rules relating to interest on partners capital

In the absence of partnership deed what are the rules relating to interest on partners capital-(d) Profit sharing ratio;(d) Profit sharing ratio;

2

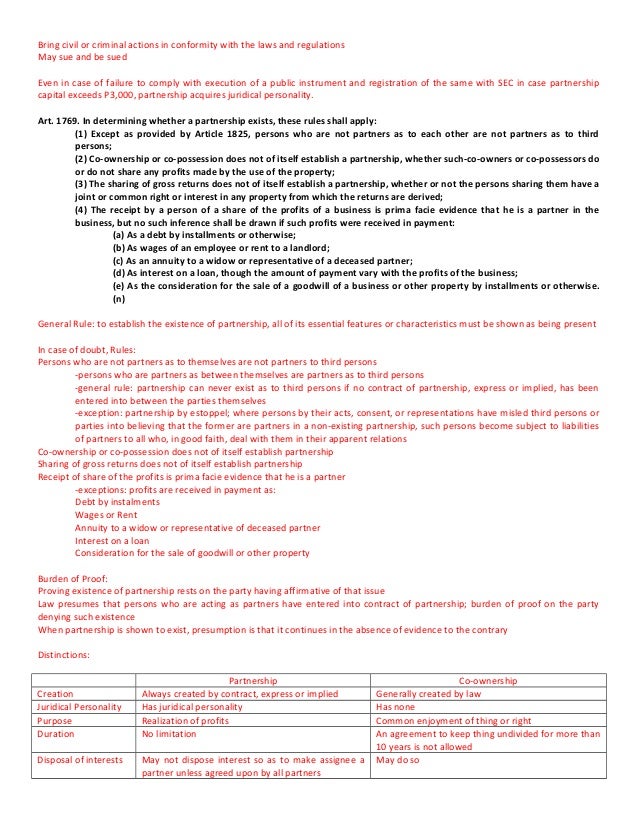

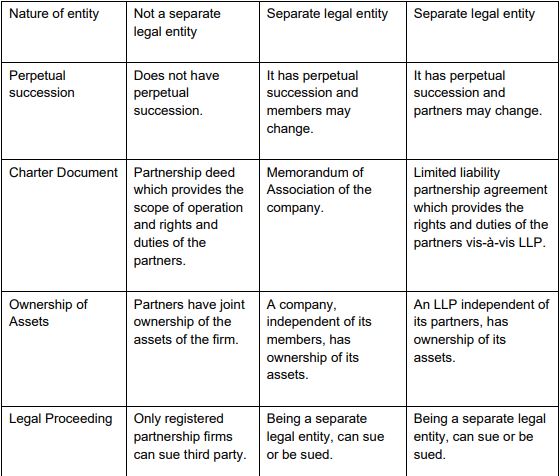

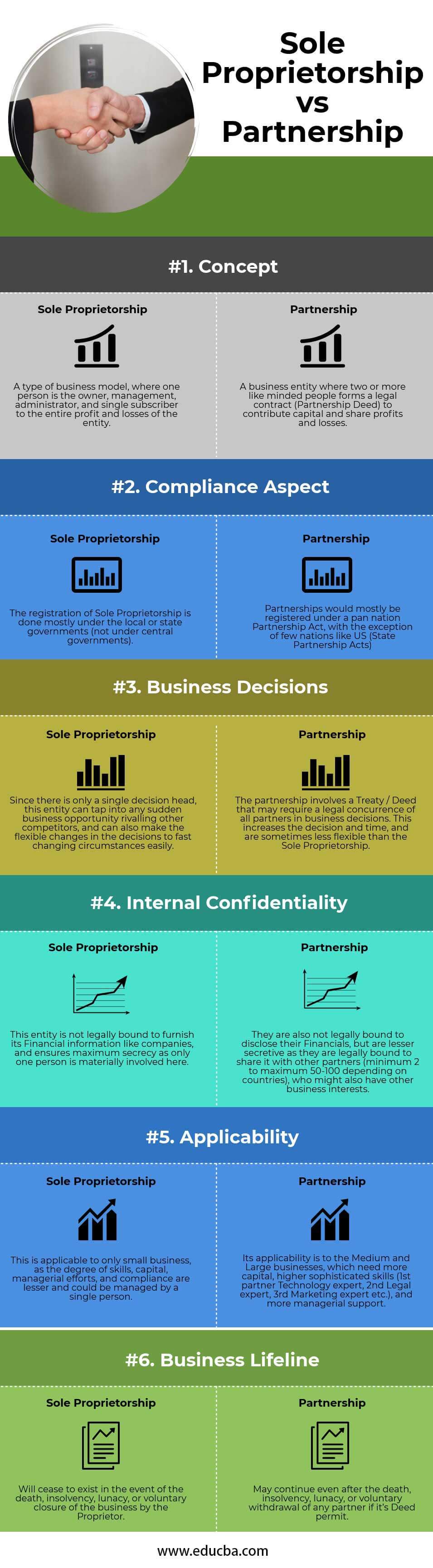

Importance of partnership deed It defines the rights, duties, and responsibilities of the partners It helps to avoid any type of misunderstanding among partners In case of any misunderstanding or dispute among the partners, it provides the method or way to settle such a dispute Hence this helps in the easy Settlement of disputesSolution Question 2 Following differences have arisen among P, Q and R State who is correct in each case a P used Rs,000 belonging to the firm and made a profitInterest on capital is not payable;

The partners do not receive a salary; Accounting rules applicable in the absence of Partnership deed Normally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the PartnersThe procedure to be adopted in case of disputes among the partners Rules to be Followed in the Absence of a Partnership Deed ADVERTISEMENTS In the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to interest on their capital 3 No partner will be allowed

(c) Interest on Loan given a partner;(b) Interest on Partner's capitals;In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses Interest on Partner's capital If partnership deed is absent, then as per Partnership Act, 1932, the partners are not entitled to interest earned on capital NCERT Solution for Class 12 Accountancy Chapter 2 Accounting for Partnership Firms Basic Concepts 3 Interest

Punainternationalschool Com

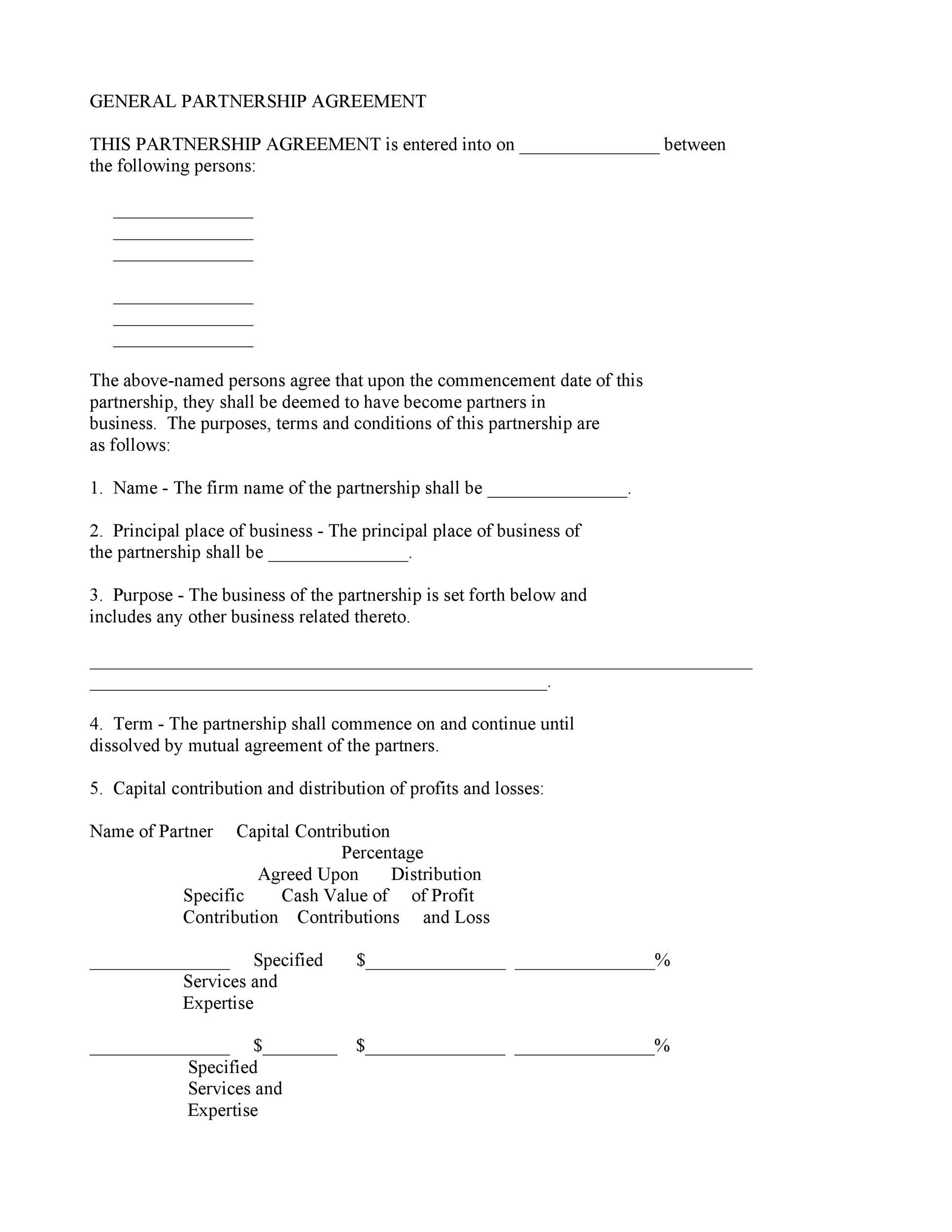

Create An Amendment To A Partnership Agreement Legal Templates

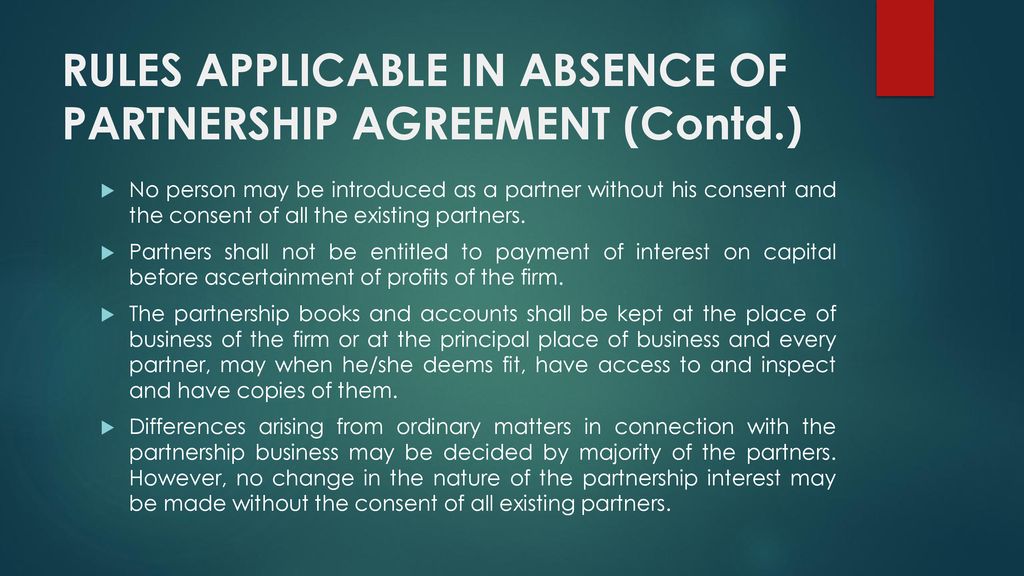

Rules applicable in the absence of Partnership Deed Interest on capital – No interest on capital will be allowed to the partners Interest on drawings – No interest on drawings is charged from the partners Interest on Loans –Interest @ 6% pa is to be allowed on the loan given by the partners to the firm Right to participate in the conduct of the business – EachIn the absence of Partnership Deed what are the rules relating to(a) Salaries of Partners; In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on partner's drawings (iv) Interest on partner's loan (v) Salary to a partner Answer(i)Sharing of Profit and Losses In the absence of partnership deed profit sharing ratio among the pad maw will be equal (ii) Interest

1

Provisions Of Partnership Deed Indian Partnership Act 1932

Rules in the absence of the Partnership Deed • (i) The partners will share the profits and losses in the equal ratio • (ii) Interest on loan will be given @ 6% pa to the partners • (iii) No interest is allowed to partners on the capital invested by them 10 • (iv) No partner is toget any remuneration such as salary, commission etc for participating in the business • (v) NoHello Guys ,This video is the third Part of Fundamental Accounting of Partnership and this video includes 1) Rules Applicable in Absence of Partnership DeeAnd (e) Interest on Partner's drawings Solution 5 (a) Salaries of Partners No partner shall be entitled any payment or commission for involvement in the conduct of the business of the

1

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

In the absence of a partnership deed and where there is no indication as to the agreement between the partners in this aspect, it should be considered as equal share for all partners The ratio may be specified in terms of absolute values or it may be expressed as the ratio of their Capital account balances or it may be based on anything else as agreed upon by the partners In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner s capital (iii) Interest on Partner s drawings (iv) Interest on Partner s loan (v) Salary to a partner Accountancy Accounting for Partnership RULES APPLICABLE IN THE ABSENCE OF PARTNERSHIP DEED As we know from the previous discusion that it is not cumpulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/creative-coworkers-standing-up-looking-at-laptop-493816423-5ba1651846e0fb0025b460b7.jpg)

What Should I Include In A Partnership Agreement

Absence of a Partnership Deed If no partnership deed is created, the following rules apply The partners have an equal share in the profits and losses of the business;Solution Question 2 In the absence of Partnership Deed what are the rules relating to(a) Salaries of Partners;

Partnership Deed Bhardwaj Accounting Academy

Partnership Deed Meaning Format Registration Stamp Duty

Partners will receive 6% per annum interest on loans to the Rules regarding Absence of Partnership Deed 1 In the absence of Partnership Deed, what are the rule relating to a) The profit for the year ended 31 st December 19 was Rs ,100 after debiting partners salaries but before charging interest on capital The partners drawings for the year were A Rs 8,000, B Rs 7,500 and C Rs 4,000 The balances on the Partners are entitled to interest on capital @ 6% per annum and salary to Bhavna @ ₹ 50,000 pa and a commission of ₹ 3,000 per month to Disha as per the provisions of the partnership Deed Bhavna's share of profit (excluding interest on capital) is guaranteed at not less than ₹ 1,70,000 pa Disha's share of profit (including interest on capital but excluding

2

2nd Puc Accountancy Question Bank Chapter 2 Accounting For Not For Profit Organisation Kseeb Solutions

In the absence of partnership deed, specify the rules relating to the following 1 Sharing of profits and losses 2 Interest on partner's capital 3 Interest on Partner's drawings 4 Interest on Partner'sloan 5 Salary to a partner Answer 1 Sharing of profits and losses If the partnership deed is silent on sharing of profit or In the absence of partnership agreement, specific rules related to the following (a) No interest on capital should be given to partners (b) No interest on drawings should be charged from the partners of the amount of withdrawals (c) Profit and losses to be shared equally by all the partners of the firm (d) The partners are entitled for 6% pa interest on the loan advanced byIn the absence of partnership deed, what are the rules relating to (a) salary of partners (b) interest on partners 'capital' (c) interest on partner's drawing's (d) Interest on partner's loan

8 Key Provisions To Include In Your Partnership Agreement Brim Law

Partnership Accounting Berel

(b) Interest on Partner's capitals;In the absence of Partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner Answer (i) Sharing of Profit and Losses In the absence of partnership deed profit the sharing ratio among the pad maw will be equal (ii Relevant Statute in the absence of Partnership Deed Following are some of the rules applicable to all the partners if the partnership deed is not prepared Proportionate allocation of profits No interest on capital is provided to any partner No interest on drawings is given No salary or commission is granted Interest on loan arranged by a partner will be given @

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

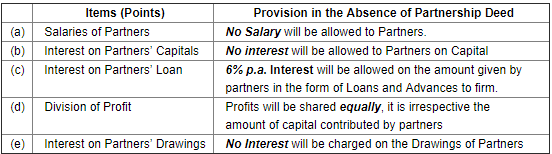

Partnership deed also defines a remuneration or salary of the partners and working partners However, interest is paid to each partner who has invested capital in the business Also Check The importance of the Partnership Agreement The above mentioned concept about Partnership Deed is explained in detail for Class 12 students To know moreTS Grewal Solutions for Class 12 Accountancy – Accounting for Partnership Firms Fundamentals (Volume I) Question 1 In the absence of Partnership Deed, what are the rules relating to a Salaries of partners, b Interest on partner's capitals, c Interest on partner's loan, d Division of profit, and e Interest on partners' drawings? A and B were sharing profits of a business in the ratio of 3 2 They admit C into partnership, who gets 1/3 of A's share of profit from A, 1/2 of B's share of profit from B The new profit sharing ratio will be– 8 In the absence of a Partnership Deed, the rate of interest allowed on the partner's loan to the firm is– 9

Partnership Rules Faqs Findlaw

Online Account Reading What Is Accounting For Partnership

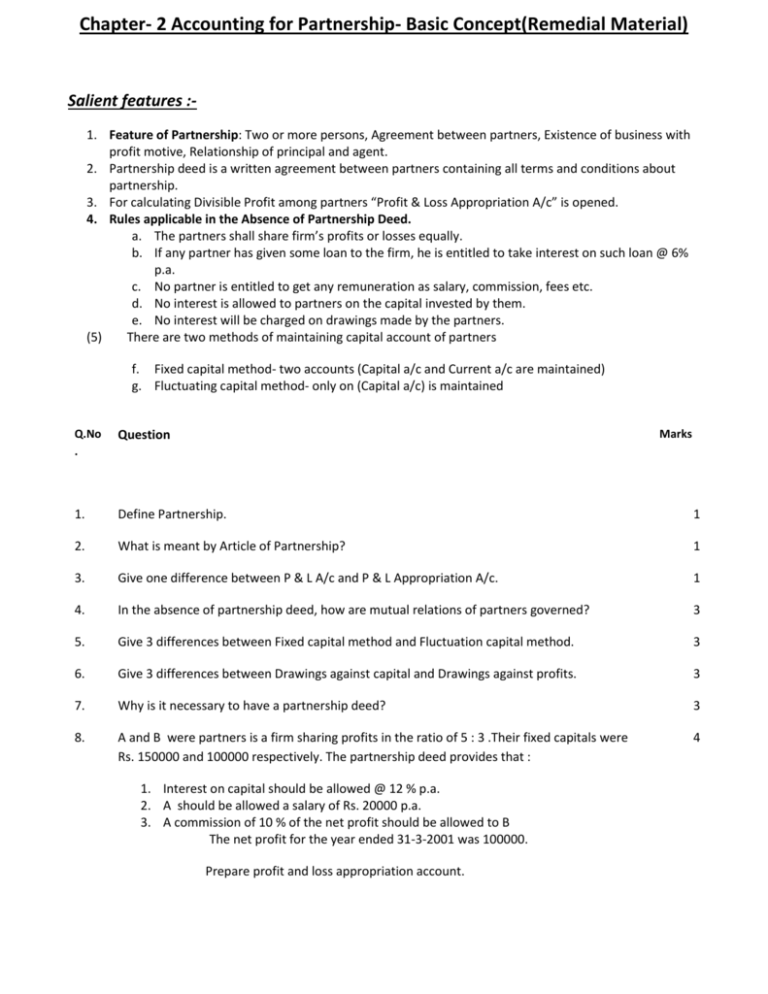

Solution Options Explanation (a) Salaries of Partners No Salary will be allowed to Partners (b) Interest on Partners' CapitalsA, B and C are partners in a firm They have no partnership deed for their guidance At the end of the year, they have faced the following problem A wants that interest on capital should be allowed to the partners but B and C do not agree State how will you settle the dispute if the partners approach you for the purpose Select the correctIn the absence of Partnership Deed AInterest will not be charged on partner's drawings,BInterest will be charged @ 5% pa on partner's drawings,CInterest will be charged @ 6% pa on partner's drawings,DInterest will be charged @ 12% pa on partner's drawings

Partnership Definition Features Advantages Limitations

Llc Partnership Profits Interest Vs Capital Interest

The Partnership Deed provides that both Reema and Seema will get monthly salary of Rs 15,000 each, Interest on Capital will be allowed @ 5% pa and Interest on Drawings will be charged @ 10% pa Their capitals were Rs 5,00,000 each and drawings during the year were Rs 60,000 each The firm incurred a loss of Rs 1,00,000 during the year ended 31st March, 18 Prepare Profit In the absence of partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, the following provisions of the Indian Partnership Act, 1932 will be applicable PROFIT SHARING RATIO Profits and losses are to be shared equally irrespective of their capital contribution INTEREST ON CAPITAL No interest onUnder the Partnership Act, the following rules will be applied in the absence of an agreement among partners i Profit or losses of the firm will be shared equally by the partners ii Interest on capital will not be allowed to any partner iii No interest will be charged on drawings iv Interest on loan will be 6% on the loan v No salary

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts Www Cbsetuts Accounting Solutions Fundamental

Profit And Loss Appropriation Account Accountancy Knowledge

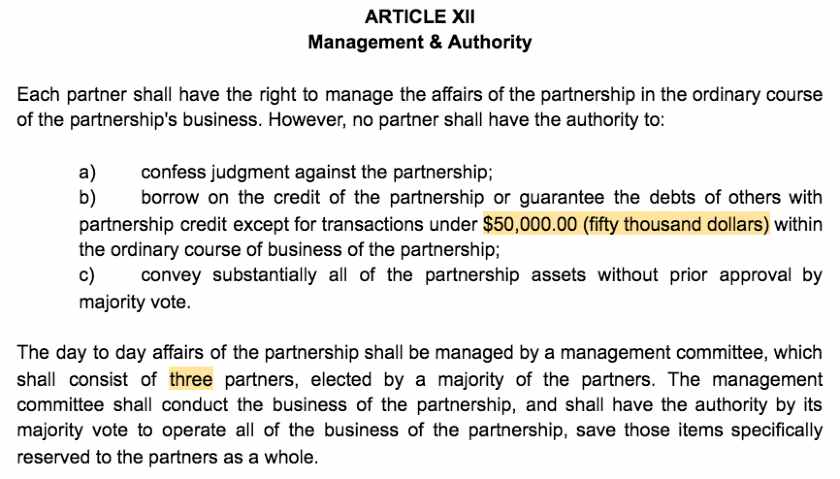

Notice to any partner who habitually acts in the partnership business of any matter relating to partnership affairs operates as notice to the firm, except in the case of a fraud on the firm committed by or with the consent of that partner 17 Liabilities of incoming and outgoing partners UK (1) A person who is admitted as a partner into an existing firm does not therebyAnd (e) Interest on Partner's drawings Solution 5 (a) Salaries of PartnersNo partner is entitled to any salary or commission for taking part in running the firm's business (b) Interest onIn the absence of partnership deed , what are the rules relating to also give reasons a salaries of partners b interest on partners capital C interest on partners loan D division of profit E interest on partners drawings

Welcome Chapter1 Accounting For Partnership Basic Concepts Introduction

2

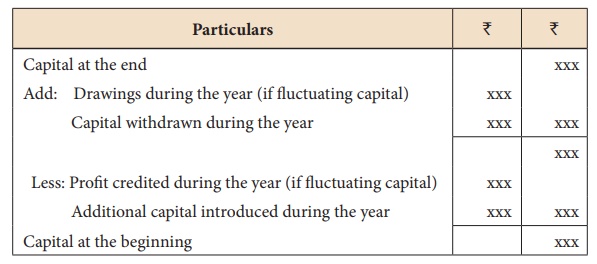

Partnership Deed Meaning Written document containing all the terms and conditions of Partnership Rules in the Absence of Partnership Deed Issues Provision 1 Salary/Commission to Partners No 2 Interest on Capital No 3 Interest on Drawings No 4 Interest on Partner's Loan 6% 5 Profit Sharing Ratio Equal Question 1 State with reasons whether the following statementsIn the absence of Partnership Deed, what are the rules relating to a Salaries of partners, b Interest on partner's capitals, c Interest on partner's loan, d Division of profit, and e Interest on partners' drawings?(iv) Interest on Partner's Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest on such loan @ 6% per annum (v) Salary to a Partner In the absence of partnership deed no partner will be entitled for getting any salary for his work even if the other is nonworking

What Is Partnership Definition Characteristics And Types Business Jargons

2

Drawings are not chargeable with interest; provision in the absence of partnership deed (a) salaries to partners No salary will be allowed to partners (b) Interest on partners No interest will be allowed to partners on their capital (c) Interest on partner loan 6% pa interest will be allowed on the money given by parters to the firm in the form of loans and advances (d(c) Interest on Loan given by a partner;

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

Accounting For Partnership

In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner

Pooling Resources Students Acca Global Acca Global

Partnership Deeds Meaning Contents With Solved Questions

Nta Ugc Net Hindi Partnership Accounts For Ugc Net By Unacademy

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

Plus Two Accountancy Part 1 Text Book Pdf Pages 101 150 Flip Pdf Download Fliphtml5

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Class 12 Accounts Fundamental Of Accounts Notes

In The Absence Of Partnership Deed What Are The Rules Relation To A Salaries Of Partners B Brainly In

Llc Partnership Profits Interest Vs Capital Interest

107 A Rules Applicable In The Absence Of Partnership Deed Accountancy Class 12 Youtube

2

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

Free Partnership Agreement Create Download And Print Lawdepot Us

In The Absence Of Partnership Deed What Are The Rules Relating To A Salaries Of Partners B Interest On Partners Capitals C Interest On Partners Loan D Division Of Profit E Interest On Partners

How To Create A Business Partnership Agreement Free Template

Partnership Accounting Sample Questions Iba Studocu

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Solution For Question No 1 Hindi Class 12th Chapter 1 Fundamentals Ts Grewal Class 12 Solutions Youtube

Free Partnership Agreement Create Download And Print Lawdepot Us

2

When Dealing In Partnership Owned Real Property Caveat Emptor New York Business Divorce

Partnership Midterm Reviewer Cc

Jaspal And Rosy Were Partners With Capital Contribution Of Rs 10 00 000 And Rs 5 00 000 Respectively They Do Not Have A Partnership Deed Jaspal Wants That Profits Of The Firm Should Be Shared

2

In The Absence Of Partnership Deed What Are The Rules Relating To A Salaries Of Partners B Interest On Partners Capitals C Interest On Partners Loan D Division Of Profit E Interest On Partners

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals

Profit And Loss Appropriation Account Accountancy Knowledge

Partnership Accounting

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Q 1 What Are Provision Relating To Governance Of Right To Share

2

Partnership Definition Features Advantages Limitations

Interest Remuneration To Partners Section 40 B

2

Remuneration To Partners In Partnership Firm Under 40 B

Interest On Loan Profit And Loss Appropriation Account Class 12 Accounts Video 4 Accountancy Youtube

40 Free Partnership Agreement Templates Business General

2

Gpo Gov

2

Partnership Agreements For Farmers Agri Businesses And Food Entrepreneurs Rincker Law Pllc

Profit And Loss Appropriation Account Accountancy Knowledge

2

All You Need To Know About The Indian Partnership Act 1932

Faqs On Limited Liability Partnership In India Lexology

2

The Presidency The Hardest Job In The World The Atlantic

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

Ncert Solutions For Class 12 Accountancy Chapter 2 Accounting For Partnership

2

2

2

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Amendmentno2annexifinal

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Solutions

Department Of Accounting And Finance Course Code Acc Ppt Download

How To Create A Business Partnership Agreement Free Template

Partnership Accounting

Class 12 Accounts Fundamental Of Accounts Notes

2

Class 12 Accounts Fundamental Of Accounts Notes

Sole Proprietorship Vs Partnership 6 Best Differences With Infographics

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Provisions Of Partnership Deed Indian Partnership Act 1932

2

Free Partnership Agreement Template Create A Partnership Agreement

Docs Bryantx Gov

1

In The Name Of God

Accountancy 1 Pages 101 150 Flip Pdf Download Fliphtml5

Partner Vis A Vis Capital Gains Sbsandco

Active Partner

Class 12 Accounts Fundamental Of Accounts Notes

2jnomj8w4bzlom

Partnership Deed Meaning Format Registration Stamp Duty

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

コメント

コメントを投稿